When comparing home loans, there are several factors to consider. Here are some tips to help you compare different home loans:

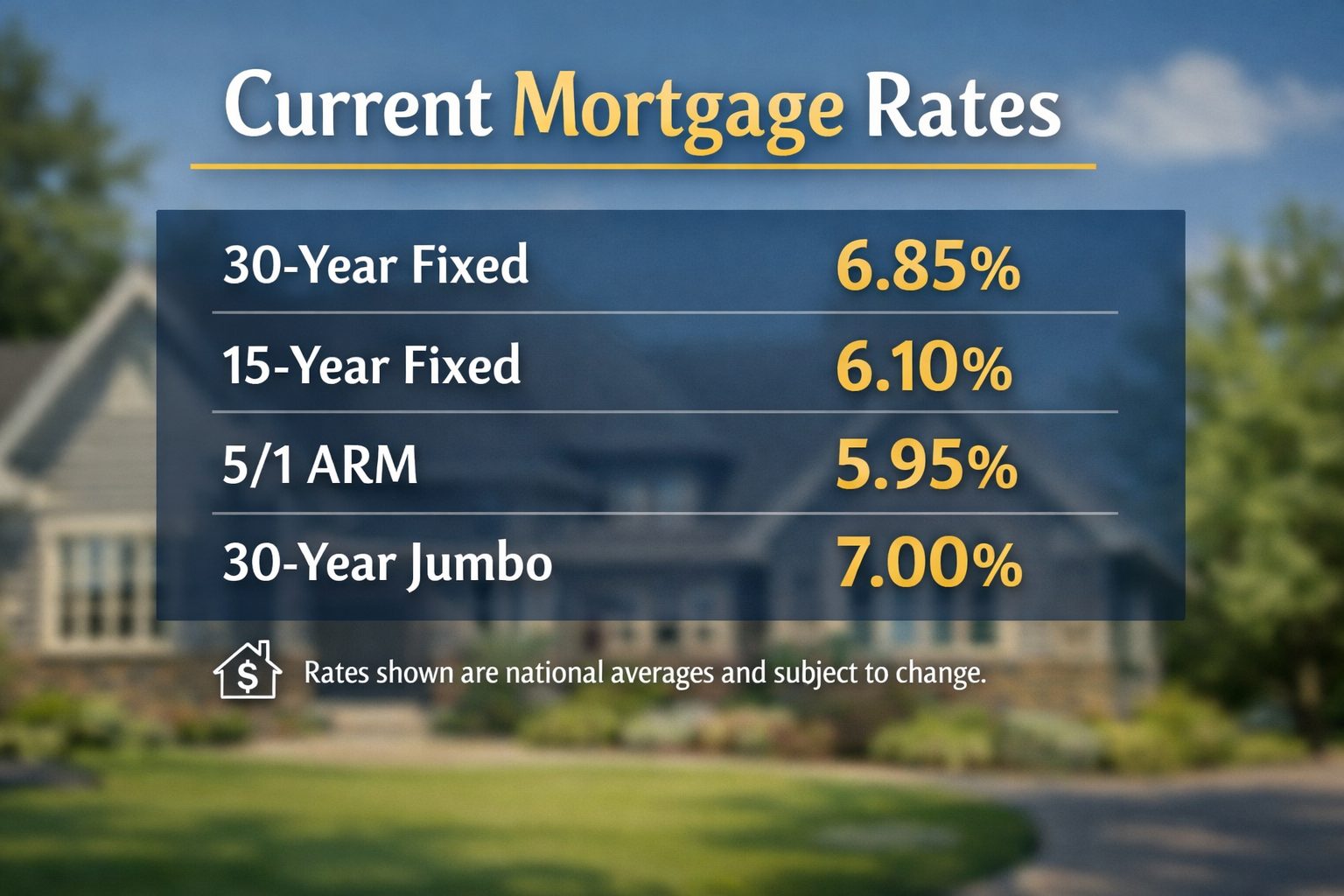

- Interest rates: Compare the interest rates offered by different lenders. A lower interest rate can save you thousands of dollars over the life of your loan.

- Fees: Look for any fees associated with the loan, such as origination fees, application fees, and closing costs. These fees can add up quickly and significantly increase the cost of your loan.

- Loan terms: Consider the length of the loan and the type of interest rate. Fixed-rate loans have a set interest rate for the life of the loan, while adjustable-rate loans have an interest rate that can change over time.

- Discount points: Some lenders offer discount points, which are fees paid upfront to lower the interest rate on the loan. Consider whether paying discount points makes sense for your situation.

- Prepayment penalties: Some loans have prepayment penalties, which are fees charged if you pay off the loan early. Make sure you understand the terms of the loan and whether there are any prepayment penalties.

- Customer service: Look for a lender with good customer service. A good lender should be responsive to your questions and concerns throughout the loan process.

- Get pre-approved: Getting pre-approved for a loan can help you determine how much you can afford to spend on a home and make the home buying process smoother 12.

To find the perfect home for your needs and budget, reach out to David Puccetti with Coldwell Banker Schneidmiller Realty located in Coeur d’Alene, Idaho at 208-699-5676 to start your home-buying journey.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link